What’s a Home Report?

Home Reports were introduced in late 2008 for the benefit of property buyers in Scotland. The intention behind Home Reports was a) to provide buyers with the information that they need to make an informed choice about purchasing a property and b) to prevent buyers from all paying for surveys on a property when only one person, ultimately, could actually buy the property.

Can I see the Home Report for any property on the market in Scotland?

With some very limited exceptions, if the property came on the market after 1 December 2008, all second-hand properties for sale must have a Home Report. And with some very limited exceptions, you are entitled to see a Home Report on any property if you request it. You just need to ask the estate agent to send you a copy. The exceptions occur if the person requesting the Home Report:

- is unlikely to have sufficient means to buy the house in question,

- is not genuinely interested in buying the house, or

- is not a person to whom the seller is likely to be prepared to sell the house.

What should I look for in the Home Report?

The Home Report consists of three elements: the Property Questionnaire, a Survey by a chartered surveyor and the Energy Performance Certificate (EPC).

The Property Questionnaire, which is completed by or on behalf of the seller of the property, contains information that might help you decide whether you are interested in the property, such as its Council Tax band.

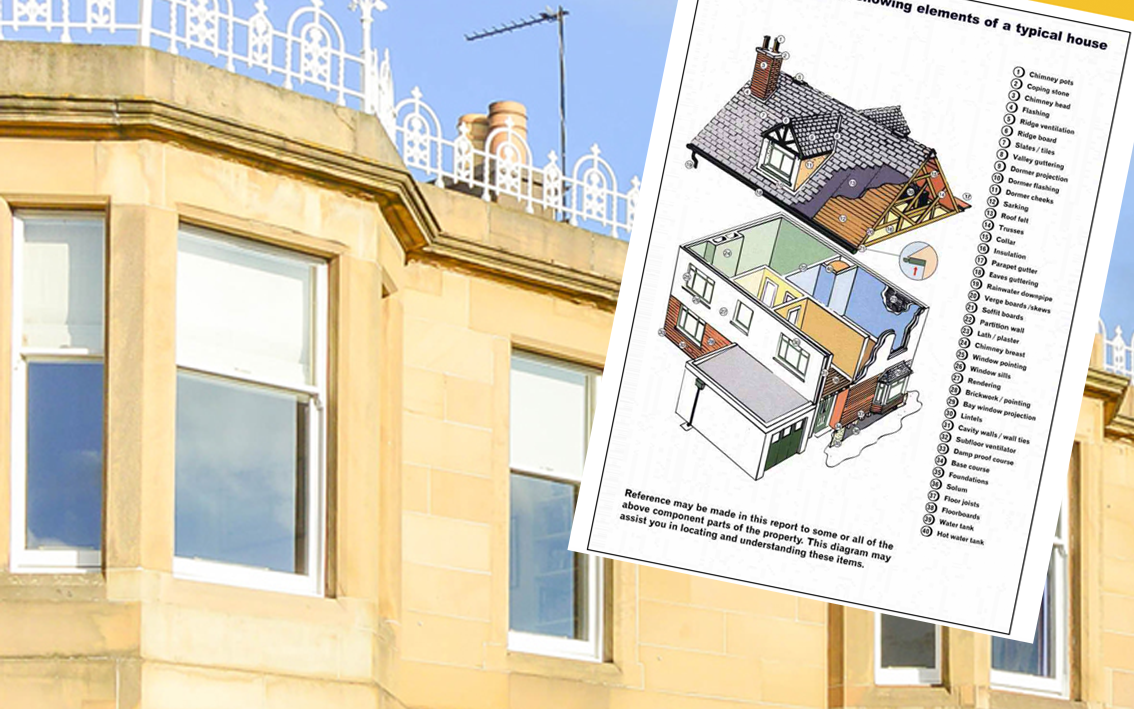

The Survey assesses the state of repair of 24 elements of the property’s condition. Every one of these elements is graded from 1 to 3 with 1 being the best and 3 being the worst. The surveyor will also flag-up issues that might be of interest to the purchaser’s conveyancing solicitor. For example, if there is evidence of windows having been replaced in the past or of changes to the internal layout of the property, the surveyor will mention these in the Home Report and recommend that the purchaser’s solicitor obtains the relevant paperwork from the seller, for example, a Building Warrant or Planning Permission. The surveyor will also provide a valuation for mortgage lenders as well as a rebuild value for the property. Every single one of these elements is liable to affect your view of whether you are interested in buying the property and can save you a lot of wasted time going to see properties that aren’t suitable for you.

The Energy Performance Certificate (EPC) outlines the environmental impact of the property, its CO2 production levels and suggestions for reducing emissions and energy bills.

Can I use the Home Report for my mortgage?

Most lenders will insist that you get a mortgage valuation done by a chartered surveyor to confirm what the property is worth. Some lenders will accept the survey in the Home Report, even though it was actually originally ordered by the property seller.

Other lenders insist that you use one of their approved surveyors and won’t accept the Home Report for this purpose. Your mortgage adviser will be able to tell you whether your lender is likely to accept the Home Report. However, even if your lender does accept Home Reports, they will usually only accept them if they are from certain ‘panel’ firms that they have pre-approved as being of a reputable standard that they find acceptable. If the Home Report isn’t from one of these ‘panel’ surveyors, the property might be less attractive to property buyers. Mortgage valuations can cost hundreds of pounds. If your lender will accept the Home Report for your mortgage, there is the potential to save quite a lot of money on the purchase.